is there real estate tax in florida

The state abolished its estate tax in 2004. History of the Florida Estate Tax.

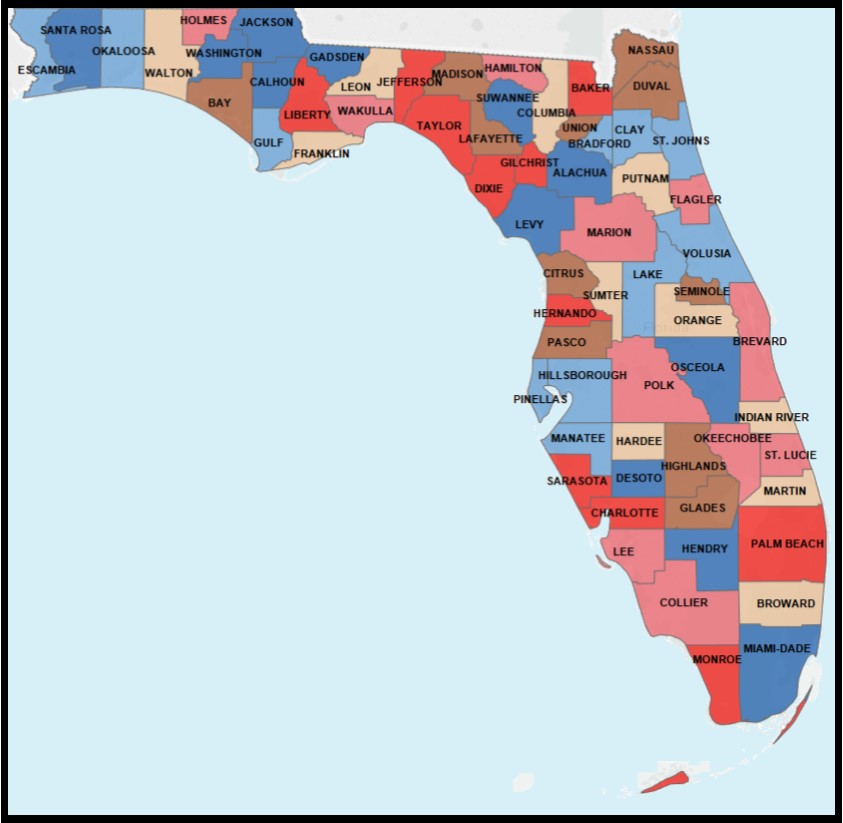

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Real estate taxes are collected annually and can be paid online by mail or in person.

. What is the Florida estate tax lien. Heres an example of how much capital gains tax you might. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

Under Florida statute 19822 there is an automatic lien against Florida estates for the purposes of ensuring that estate taxes are paid in. Prior to the change in 2004 federal law allowed a credit. Florida property owners have to pay property taxes each year based on the value of their property.

Partial deferred and installment payments are also available. Florida property and sales tax support most state and local government funds since the state does not charge personal income tax. Property taxes apply to both.

Its called the 2 out of 5 year rule. Since floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after january 1 2005. According to section 193155 FS property appraisers must assess homestead property at just value as of January 1 of each tax year.

While this isnt an income tax deduction this is a good opportunity to remind homeowners who purchased your home in 2021 that you must file for your Homestead. Counties in Florida collect an average of 097 of a propertys assesed fair. The Florida real estate homestead tax exemption is by far the most popular and common way to reduce your property tax bill.

Available to all residents and amounting to a maximum of 50000 off the assessed value of the property. These tax statements are mailed out on or before. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

Further for all other types of transfers in Miami-Dade County there. Currently there is no estate tax in Florida. Why are property taxes so high in Florida.

What is the Florida property tax or real estate tax. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences.

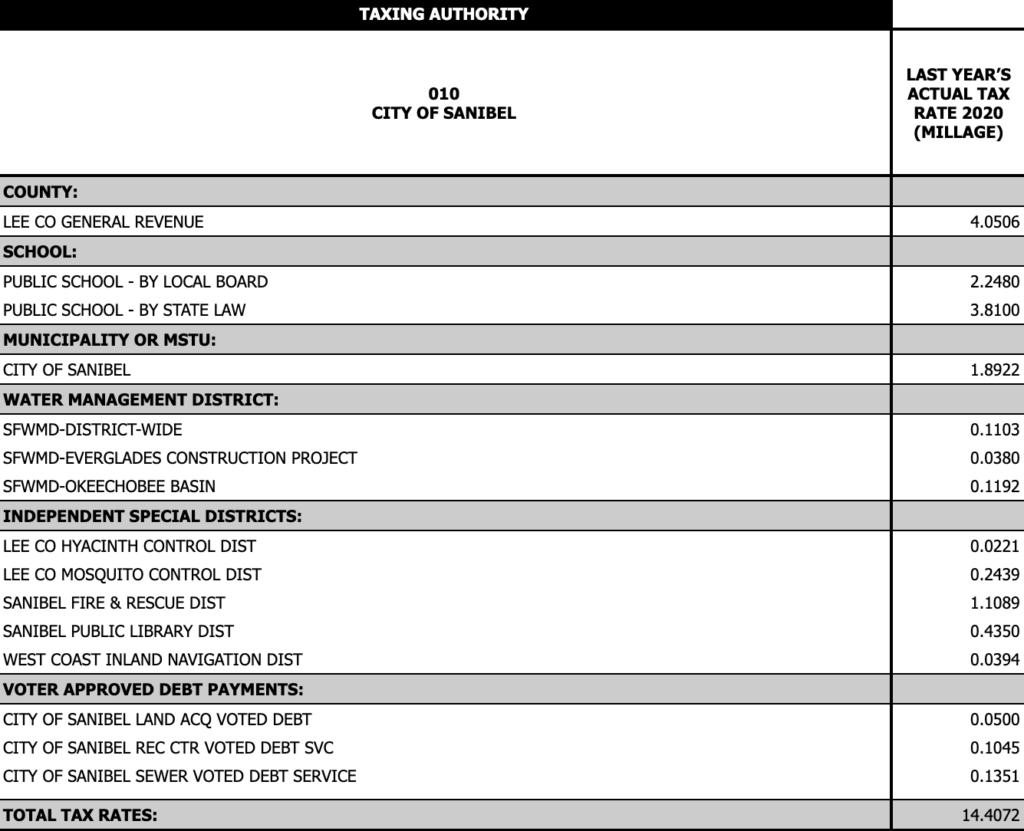

Florida real property tax rates are implemented in millage. In accordance with Florida Statute. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. This property tax exemption is not limited to the elderly or. In the year after the property receives the homestead.

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Property Values Are Up So What About Taxes Florida Realtors

Florida Property Taxes Explained

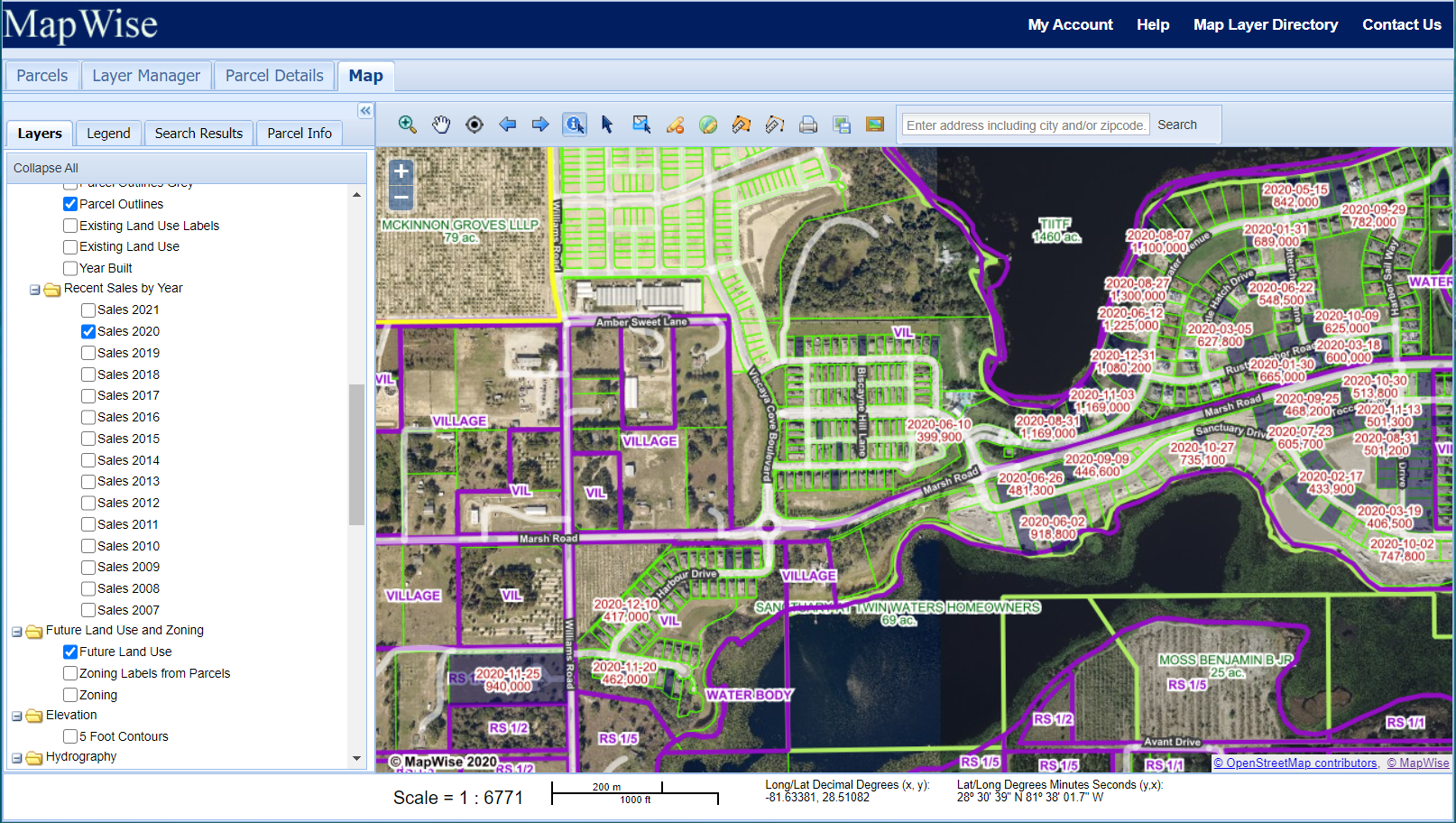

Florida County Property Appraiser Search Parcel Maps And Data

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Florida Dept Of Revenue Property Tax Data Portal County Profiles

Property Taxes Brevard County Tax Collector

Tax Rates To Celebrate Gulfshore Business

How To Calculate Fl Sales Tax On Rent

Tallahassee Property Taxes Real Estate Advice

In Florida Homeowners Come For The Weather And Stay For The Tax Relief

What Is A Florida County Real Property Trim Notice

Real Estate Property Tax Constitutional Tax Collector

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation